Disney’s recent Q3 earnings report highlights several company successes, but there’s no denying that theme park attendance has taken a hit.

Disney Theme Park Attendance Flat

During the earnings call, The Walt Disney Company discussed its latest financial performance, including revenue streams across its various sectors. However, when the conversation turned to theme park attendance, the company was less forthcoming about the specifics.

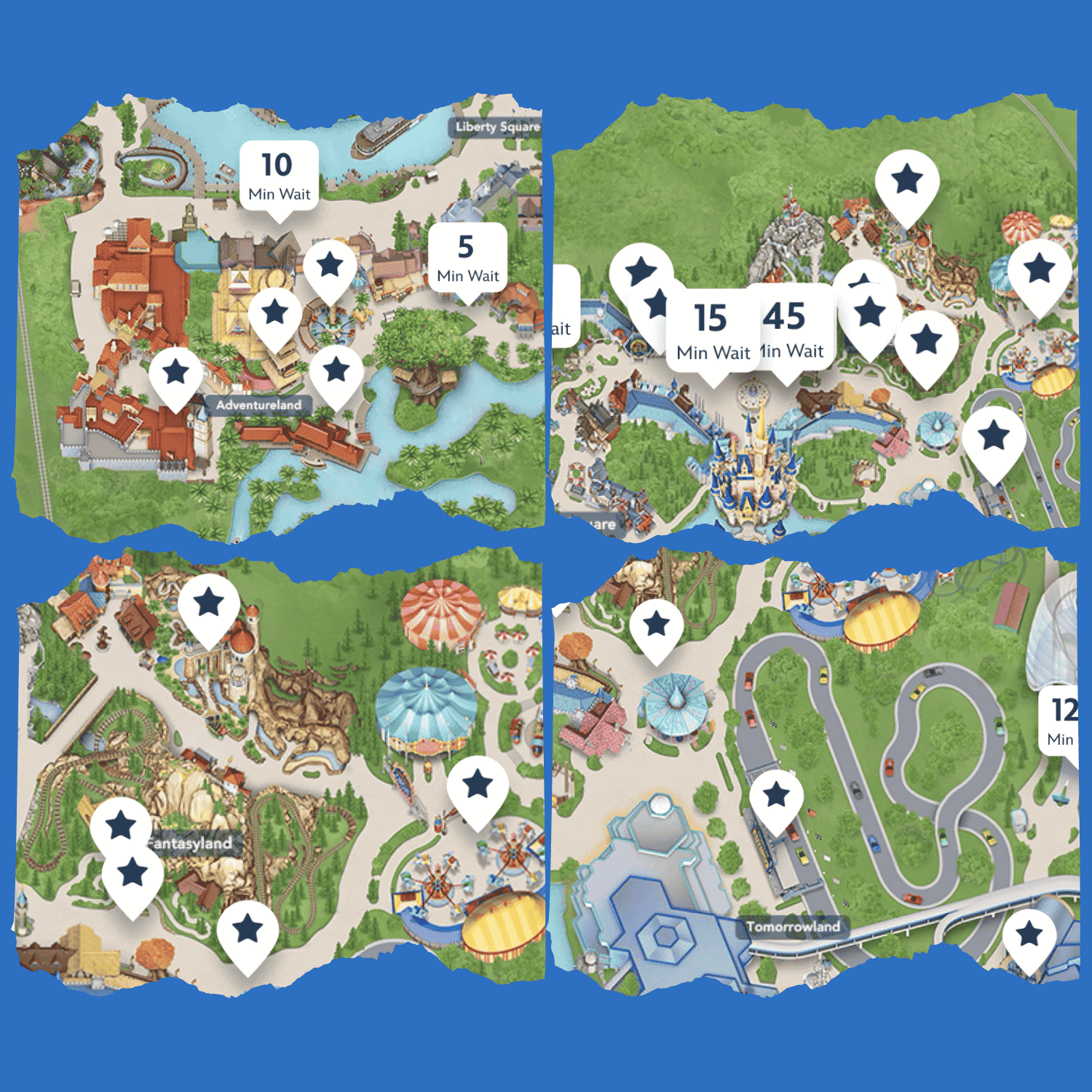

For many, a trip to a Disney theme park, whether in the U.S. or abroad, is a dream come true or a once-in-a-lifetime experience. However, with ticket prices steadily increasing, the introduction of the paid Lightning Lane system (replacing the once-free FastPass+), and a reduction in perks for hotel stays, it’s becoming harder for some to justify or afford these visits.

Higher Income Travellers Going International

CFO Hugh Johnston addressed the decline in theme park attendance, acknowledging its significance given the role parks play in Disney’s overall profits. He noted that “higher income consumers are traveling internationally much more. Those people, we think, are eventually going to come back.”

So, what does this mean? It’s possible that the cost of a Disney World vacation has become so comparable to an international trip that many “higher income consumers” are choosing to explore destinations beyond Disney’s domestic parks. Does this indicate that Disney’s vacation prices have reached a plateau? Johnston and the company don’t seem too concerned about that just yet.

He further explained, “Our parks business tends to get hit late, it gets hit less, and it recovers early in comparison to the other theme parks out there.” He attributed this resilience to Disney’s strong intellectual property (IP) portfolio, concluding, “I do believe the parks business is fundamentally in good shape.”

Disney Box Office Driving Growth

The company’s success at the box office is also driving growth, particularly through licensing and streaming. Disney’s strategy has increasingly focused on leveraging its IP across multiple platforms, including movies, streaming, and consumer products.

Despite these challenges, Disney’s park operating income did decline this quarter, attributed to higher costs driven by inflation, among other factors. Nevertheless, Disney seems relatively unconcerned about this “financial slowdown.”

While revenue growth was dampened by lower consumer demand towards the end of the third quarter, this hasn’t alarmed Disney. The company is heavily investing in new ventures, including cruise ships, hotels, and theme park expansions, all of which are expected to yield significant revenue by 2025. Even with current slowdowns in their Experiences division, Disney appears confident in the future.

It will be interesting to see how theme park attendance recovers by the next quarterly earnings call. Disney anticipates that full recovery may take several quarters. It’s worth noting that Comcast, the owner of Universal Studios, also reported a 10.6% decline in its parks business during Q2 due to lower domestic attendance, making Disney’s news less surprising.